Compare your options today

Considering a Medicare plan over your group insurance?

We can help make that decision easier.

We already work with your current plan provider to compare apples to apples.

STILL NOT SURE?

Frequently Asked Questions

We understand that a big change can be confusing - that's why we simplify the process.

Do I have to sign up for Medicare at 65 if I’m still working?

Not always!

If you have creditable coverage through an employer with 20 or more employees, you can delay Medicare Part B and D without penalty. Your employer plan remains primary, and Medicare acts as secondary coverage if you enroll later.

However, if your employer has fewer than 20 employees, Medicare generally becomes primary, and you’ll need Part A and Part B to avoid gaps in coverage.

What if I’m covered under my spouse’s employer plan?

The same rule applies - it depends on your spouse’s employer size.

If your spouse works for a large employer (20+ employees), you can usually delay Medicare.

If it’s a small employer, Medicare becomes primary, and the group plan pays second.

Always confirm with the HR department before making any changes.

Can I keep my employer insurance and enroll in Medicare too?

Yes, you can have both!

Many people enroll in Part A (which is usually free) while keeping their employer plan for other coverage.

If the employer plan remains primary, you can delay Part B to avoid paying the premium twice.

If Medicare is primary, it’s essential to have both to avoid unpaid claims.

What are the costs for Medicare Part B in 2025?

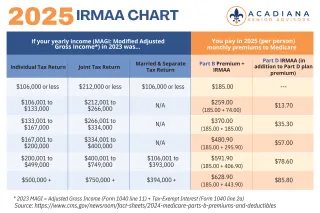

The standard Part B premium is $185.00/month, with an annual deductible of $257.

Higher-income individuals may pay more due to IRMAA (Income-Related Monthly Adjustment Amount) — a surcharge based on your income from two years prior.

See our full IRMAA chart for details and examples →

What happens to my HSA if I enroll in Medicare?

Once you enroll in any part of Medicare (even Part A), you cannot contribute to an HSA anymore — though you can still spend existing funds for qualified expenses.

If you plan to keep contributing, delay both Part A and Part B until you’re fully ready to retire.

Be careful: Part A enrollment is retroactive up to 6 months, so stop HSA contributions before your Medicare start date.

How does IRMAA affect me if I’m retiring soon?

If your income was higher two years ago but has since dropped (for example, after retirement), you can appeal IRMAA using Social Security Form SSA-44.

Qualifying life events include retirement, reduced hours, loss of income, or the death of a spouse.

Once approved, your premiums adjust to reflect your current income level.

Do I need a Part D drug plan if my employer coverage includes prescriptions?

If your employer’s drug coverage is considered creditable (as good as or better than Medicare’s standard), you can delay Part D without penalty.

Ask HR for a Creditable Coverage Letter before you retire.

Once you lose that coverage, you must enroll in Part D within 63 days or face a lifetime penalty.

What happens if I miss my Medicare enrollment deadline?

If you miss your Part B SEP, you’ll have to wait until the General Enrollment Period (Jan 1 – Mar 31) to enroll, and your coverage won’t start until July.

You’ll also face a 10% penalty on your Part B premium for each full 12-month period you delayed without creditable coverage - for life.

The same applies for Part D (1% penalty per month delayed).

Is there a penalty if I delay only Part D and not Part B?

Yes - the Part D penalty is separate and permanent.

You’ll pay 1% of the national base premium ($36.00 in 2025) for every month you were eligible but didn’t have creditable drug coverage.

That penalty adds to your premium each month for life.

What if my employer plan costs less than Medicare?

It’s possible!

Especially if your employer heavily subsidizes your premiums.

However, check your total out-of-pocket potential and drug costs. Medicare may be more predictable, especially with supplements or MAPD plans that include extras (vision, dental, gym memberships).

Submit your current medication list through Our Submit Your Info tool to see the full picture.

Can my spouse stay on my employer plan if I move to Medicare?

Usually yes, as long as you continue employment and the employer allows it.

However, once you retire, your spouse may need to seek their own coverage (such as an ACA marketplace plan) until they qualify for Medicare at 65.

Check with your HR department for dependent coverage rules.

What’s the easiest way to see if switching saves me money?

Use our secure RetireFlo form to share your prescriptions, preferred pharmacy, and doctors.

We’ll compare your total annual cost across all Medicare Supplement and Advantage options in your area — not just premiums, but what you’ll really spend on prescriptions and visits.

(Button: “Start My Free Review” → RetireFlo link)

Does Medicare cover dental, vision, or hearing?

Original Medicare (Parts A & B) does not cover routine dental, vision, or hearing.

Some Medicare Advantage (MAPD) plans include these benefits, or you can add stand-alone coverage.

We’ll include those options in your comparison if you check that these are important to you.

What’s the first step I should take right now?What’s the first step I should take right now?

1. Confirm your employer’s size and whether your coverage is creditable.

2. Gather your medication list and preferred pharmacies.

3. Use our Submit Your Info link to request a free, no-obligation cost comparison.

4. We’ll contact you with personalized recommendations before you make any changes.

What Do They Say About Us?

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. here

Copyrights 2025 | Compare to Medicare | Terms & Conditions